All Categories

Featured

It's probably more economical than you believe! Among the largest advantages of term insurance is its affordability. The expense for coverage is different for every person and some might have the ability to get term life insurance policy for just $8.24 a month. How much your life insurance policy expenses will depend on just how much insurance coverage you want, exactly how long you require it for, and things like your age and health and wellness background.

When participants were asked to estimate the cost of a $250,000 term life plan for a healthy and balanced 30-year-old, more than fifty percent said $500 annually or more. In truth, the typical price is closer to $160, which is cheaper than the typical expense for a yearly gym subscription. According to a report by Cash Under 30, that is around the very same quantity you may invest in one readily ready meal in a restaurant.

* Insurance coverage alternatives begin at $5,000 and go up to $2 million or more through eFinancial. Via Progressive Life Insurance policy Company, coverage options variety from $50,000 to $1 million.

Have added questions? Modern Answers is your resource for all things insurance policy. See all our life insurance policy ideas and resources.

You can obtain against your cash money worth if the need emerges. Any kind of unsettled loan equilibrium, plus interest, is subtracted from the survivor benefit. Your eligible partner can obtain this same irreversible security. A spouse includes a legal partner as defined by state legislation. We encourage you both to consider this coverage to help secure those you leave behind.

If you are not 100% satisfied for any type of reason, merely cancel within the initial 30 days and your premium will certainly be reimbursed in complete. If fatality results from suicide in the initial 2 years of coverage (one year in ND and CARBON MONOXIDE), we will return all of the premiums you have actually paid without passion.

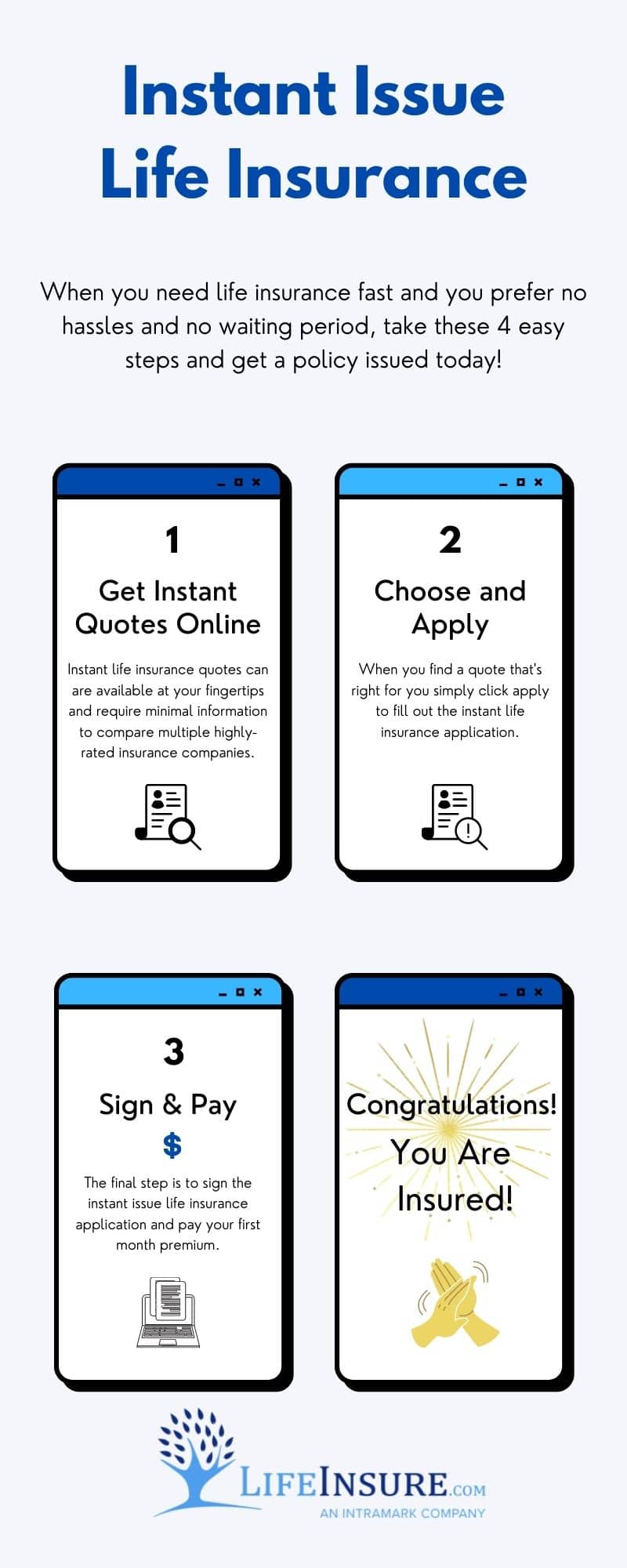

Cheap Instant Life Insurance

Before getting any type of life insurance, here are a couple of things you ought to know: In order to assess your application for insurance policy, CMFG Life Insurance policy Firm might ask you to finish inquiries on an application. Via these inquiries you will certainly provide us with clinical or other individual details concerning yourself and any kind of other individual to be insured.

This additional information will certainly assist us better comprehend the responses you have actually supplied on your application. Medical information we accumulate concerning you will not be made use of or launched for any function other than as accredited by you, to underwrite insurance; to administer your plan; examine and report fraud; or as called for by law.

Box 61, Waverly, IA 50677-0061. With the collection and use of this information we seek to use you protection at the most affordable possible expense. THIS NOTICE IS TO BE READ BY THE CANDIDATE FOR INSURANCE POLICY. CU-SINOTICE-2004 For citizens of CA, CT, FL, RI and VT: You may call a person as Second Addressee in the rooms given on the application.

If you select to finish the Secondary Information on the application, that person would certainly likewise receive notification of expired insurance coverage in the event your premiums are not paid. If you select to mark a Secondary Addressee in the future, or transform the individual you assigned, you may do so at any kind of time by creating CMFG Life Insurance Firm.

Latest Posts

Burial Insurance Cost

Best Funeral Plan For Over 70

Senior Care Final Expenses